The CarFinance 247 Used Car Price Index reports jump in average purchase price to £10,434 in October 2021, 11% up from £9,364 in October 2020, and up 6.25% since the last report in July

CarFinance 247, the UK’s leading online motor finance platform, has reported an 11% rise in the price of vehicles sold, echoing rising inflation across the economy.

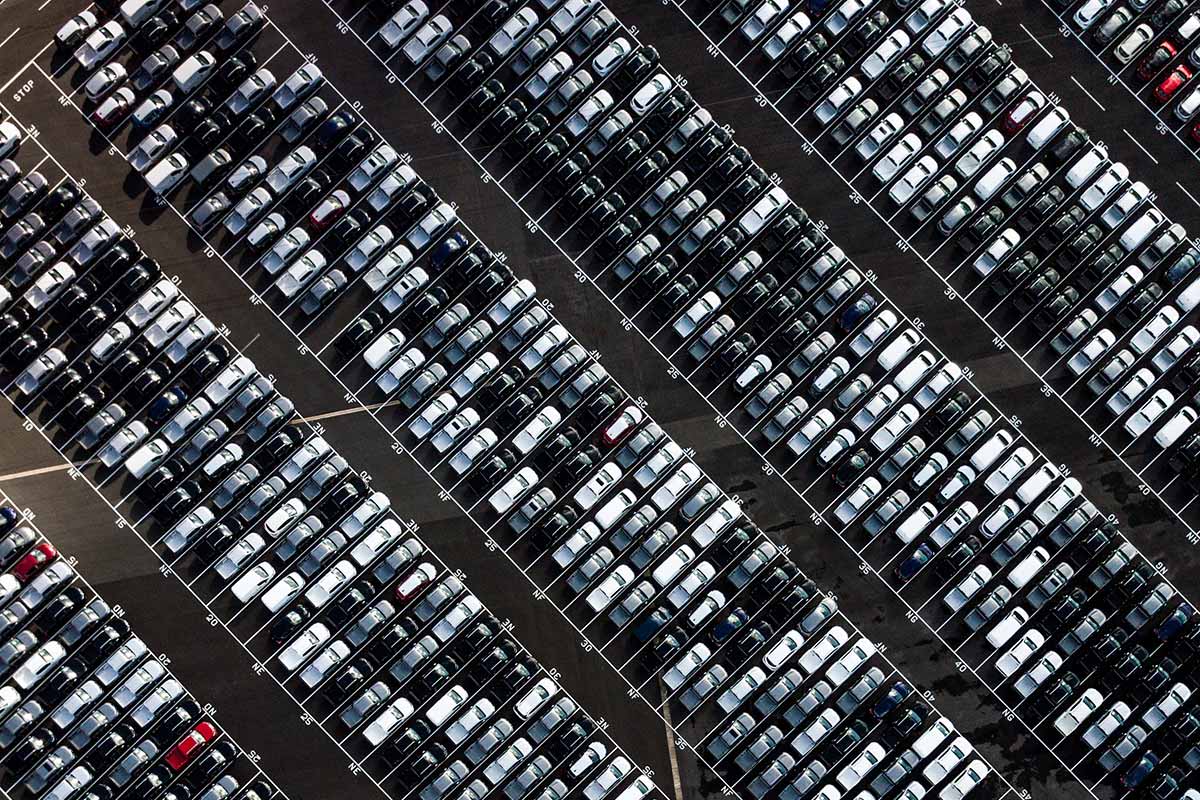

The average purchase price for cars bought on the platform was £10,434 in October 2021, up from £9,364 in October 2020, and up 29% from £8,034 in October 2019. Prices are rising as the number of new cars produced and registered continues to decline. The number of vehicles listed by CarFinance 247’s network of around 4,000 independent dealers remained steady at 103K, as used car demand continues to outstrip supply on forecourts.

Prices are rising fastest in London, jumping 32% year on year to £15,205, a sign that consumers may be looking for newer, greener models to beat the ULEZ charge. In the North East, prices rose 11% to £9,634, and in Scotland, by 12% to £10,830. Bucking the trend, the South West saw prices rise by just 2% to £9,026 with prices falling back from their £10,830 peak in August.

Used car prices are being driven high due to constraints in the supply of new cars across the world. Car manufacturers are facing continued pressure from the global semiconductor shortage. Chip demand continues to outpace supply thanks to increased use in modern vehicles, forcing manufacturers to cut, or even temporally stop, production. As the UK economy recovers, demand for vehicles is also on the rise, with CarFinance 247 financing 41% more cars in September 2021 than September 2020. Reduced supply combined with increased demand for vehicles has created a perfect storm for used car price inflation.

As prices continue to rise, CarFinance 247 has also seen an increase in the part exchange value its consumers are receiving from dealers. This has been reflected in the deposits put down on vehicles by buyers, which have doubled since 2019.

With car prices growing rapidly, CarFinance 247 is seeing surging demand for its services, with applications for finance soaring to 95,000 a month, leading the firm to increase its workforce by 20%.

Commenting on the data, Reg Rix, CEO of the 247 Group, said: “The UK’s used car market continues to boom. The international supply of new cars continues to lag demand as consumers look to get back on the road. New car technology is developing apace, with more dynamic features than ever before. This, alongside increased demand for new consoles and phones, has pushed global stocks of computer chips to breaking point. New car manufacturers can’t get the parts, and this is causing the squeeze in the used car market. It’s easy to assume inflationary pressures only impact new products, but in markets that have a high degree of reselling, when supply contracts and demand remains strong, these pressures feed through to the used market.

“Dealers in our network have struggled to source vehicles during the pandemic, and with no immediate solution in sight, we expect to see continued growth in the market. With prices on the rise, consumers are increasingly looking to CarFinance 247 to make finding and funding their ideal car a reality, whatever deposit they are working with.”